This is an encore presentation of an article Michael Chusid wrote about 20 years ago. It's message is still current.

I often encounter price resistance when selling my company’s top-of-the-line building products. Even though I explain that the product lasts longer and has lower operating costs, many customers can’t see past the initial costs. How can I overcome this sticker shock?—D. N. S. , sales manager

Developers and building owners think of their projects as an investment. In addition to construction costs, they analyze operating costs, potential income, and resale value. To overcome price resistance, present your product as an investment instead of an expense.

In some cases, this can be done by focusing on how your product adds value to a building. Developers recognize this principle when they spend extra on building finishes or fashionable interiors. Their investment is repaid by making it easier to sell the property or attract higher rental income.

Other products can be positioned as expenses necessary to protect a property’s income potential. A major hotel chain, for example, invests in backup air-conditioning equipment because they realize their inventory of rooms is worthless if they can’t guarantee comfort.

Tout up-front savings

Another approach is to emphasize the “first cost” of your product. In addition to purchase price, this includes the design, construction, and financing costs necessary to put your product into service. You can sell the first-cost benefits of your product if, for example, it costs less to install or enables faster completion of a project.

A still broader view of costs is a lifecycle cost analysis, which considers the cost of owning a product, not just purchasing it. This is significant because the total of a building’s maintenance, energy, insurance, tax, interest, and other ownership expenses usually exceed construction costs.

Life-cycle affordability is key

Life-cycle cost analysis has long been used by mechanical engineers; it is fairly simple to compare the cost of additional insulation or more-efficient equipment to projected energy savings. But in recent years, life-cycle affordability has become increasingly important. Environmental concerns, for example, have shifted attention from construction costs to issues such as energy consumption and building materials disposal. Institutions like the Army Corps of Engineers have begun to require life-cycle cost analyses of proposed projects. A recent publication from the American Society for Testing and Materials, ASTM Standards on Building Economics, establishes procedures for investigating the life-cycle costs of building materials. And computer programs have simplified the extensive number crunching required for life-cycle cost calculations.

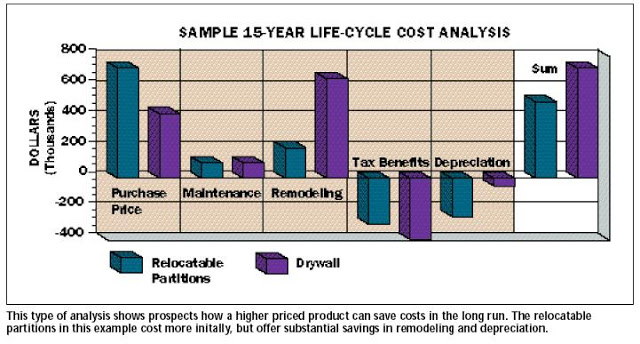

Many manufacturers claim life-cycle benefits in their advertising, using bar charts to show how their products’ costs compare to competitors. Such claims have more impact if your customers can examine the supporting data. You can use computerized presentations to show them results for a specific product.

USG Interiors is one company that uses computerized life-cycle cost analyses to position its relocatable office partitions against lower priced conventional drywall partitions. The program considers such variables as the client’s tax bracket, material and labor costs, project size and complexity, mortgage terms, and the accelerated depreciation allowed to relocatable partitions. It also asks the customer how often remodeling will occur. The program then compares the life-cycle benefit of USG’s reusable partitions with the demolition costs of removing drywall partitions. This gives USG a powerful sales tool to use with financially oriented customers who may not perceive the product’s technical or aesthetic benefits. In addition, getting the customer to say yes to all the input data increases his acceptance of the program’s conclusions.

Are your products priced right?

Conducting a life-cycle cost analysis for your product can be a fruitful marketing exercise. For example, do you know what factors most affect the affordability of your product and your competitors’ products? Can you substantiate product durability or quantify maintenance costs? Would your products be more affordable if there were more demand for salvaged or recycled components?

A life-cycle cost investigation I once conducted for a water-conserving plumbing system helped the manufacturer establish a competitive price for its product. Another time I compared the life-cycle costs of 12 roofing systems. Even though my client’s roofing system had outstanding durability, the study showed its high initial cost was not offset by low life-cycle maintenance costs. This insight helped clarify the manufacturer’s marketing alternatives.

While life-cycle costs can be an important sales tool, you must still tailor your presentation to each individual customer. Many price objections are simple requests for more information or reassurances. Other objections may be based on unquantifiable concerns about performance, appearance, or reliability. Bringing out a technical looking spreadsheet could confuse some customers or miss their main concerns.

For some customers, delivering a job for the lowest initial cost will always outweigh life-cycle considerations. But in other cases, a life-cycle cost argument may be just what is needed to close a sale. It can help customers justify to themselves or to their clients the decision to use a more expensive product. Or it can be a subtle way of pointing out a competitor’s shortcomings. Most importantly, it can change the focus of a sales presentation from the cost of your product to the value of your product.

Have a question you'd like us to answer?

Send an email to michaelchusid@chusid.com

By Michael Chusid. Originally published in Construction Marketing Today, Copyright © 1994

I often encounter price resistance when selling my company’s top-of-the-line building products. Even though I explain that the product lasts longer and has lower operating costs, many customers can’t see past the initial costs. How can I overcome this sticker shock?—D. N. S. , sales manager

Developers and building owners think of their projects as an investment. In addition to construction costs, they analyze operating costs, potential income, and resale value. To overcome price resistance, present your product as an investment instead of an expense.

In some cases, this can be done by focusing on how your product adds value to a building. Developers recognize this principle when they spend extra on building finishes or fashionable interiors. Their investment is repaid by making it easier to sell the property or attract higher rental income.

Other products can be positioned as expenses necessary to protect a property’s income potential. A major hotel chain, for example, invests in backup air-conditioning equipment because they realize their inventory of rooms is worthless if they can’t guarantee comfort.

Tout up-front savings

Another approach is to emphasize the “first cost” of your product. In addition to purchase price, this includes the design, construction, and financing costs necessary to put your product into service. You can sell the first-cost benefits of your product if, for example, it costs less to install or enables faster completion of a project.

A still broader view of costs is a lifecycle cost analysis, which considers the cost of owning a product, not just purchasing it. This is significant because the total of a building’s maintenance, energy, insurance, tax, interest, and other ownership expenses usually exceed construction costs.

Life-cycle affordability is key

Life-cycle cost analysis has long been used by mechanical engineers; it is fairly simple to compare the cost of additional insulation or more-efficient equipment to projected energy savings. But in recent years, life-cycle affordability has become increasingly important. Environmental concerns, for example, have shifted attention from construction costs to issues such as energy consumption and building materials disposal. Institutions like the Army Corps of Engineers have begun to require life-cycle cost analyses of proposed projects. A recent publication from the American Society for Testing and Materials, ASTM Standards on Building Economics, establishes procedures for investigating the life-cycle costs of building materials. And computer programs have simplified the extensive number crunching required for life-cycle cost calculations.

Many manufacturers claim life-cycle benefits in their advertising, using bar charts to show how their products’ costs compare to competitors. Such claims have more impact if your customers can examine the supporting data. You can use computerized presentations to show them results for a specific product.

USG Interiors is one company that uses computerized life-cycle cost analyses to position its relocatable office partitions against lower priced conventional drywall partitions. The program considers such variables as the client’s tax bracket, material and labor costs, project size and complexity, mortgage terms, and the accelerated depreciation allowed to relocatable partitions. It also asks the customer how often remodeling will occur. The program then compares the life-cycle benefit of USG’s reusable partitions with the demolition costs of removing drywall partitions. This gives USG a powerful sales tool to use with financially oriented customers who may not perceive the product’s technical or aesthetic benefits. In addition, getting the customer to say yes to all the input data increases his acceptance of the program’s conclusions.

|

| From a life-cycle cost analysis prepared by Chusid Associates. |

Conducting a life-cycle cost analysis for your product can be a fruitful marketing exercise. For example, do you know what factors most affect the affordability of your product and your competitors’ products? Can you substantiate product durability or quantify maintenance costs? Would your products be more affordable if there were more demand for salvaged or recycled components?

A life-cycle cost investigation I once conducted for a water-conserving plumbing system helped the manufacturer establish a competitive price for its product. Another time I compared the life-cycle costs of 12 roofing systems. Even though my client’s roofing system had outstanding durability, the study showed its high initial cost was not offset by low life-cycle maintenance costs. This insight helped clarify the manufacturer’s marketing alternatives.

While life-cycle costs can be an important sales tool, you must still tailor your presentation to each individual customer. Many price objections are simple requests for more information or reassurances. Other objections may be based on unquantifiable concerns about performance, appearance, or reliability. Bringing out a technical looking spreadsheet could confuse some customers or miss their main concerns.

For some customers, delivering a job for the lowest initial cost will always outweigh life-cycle considerations. But in other cases, a life-cycle cost argument may be just what is needed to close a sale. It can help customers justify to themselves or to their clients the decision to use a more expensive product. Or it can be a subtle way of pointing out a competitor’s shortcomings. Most importantly, it can change the focus of a sales presentation from the cost of your product to the value of your product.

Have a question you'd like us to answer?

Send an email to michaelchusid@chusid.com

By Michael Chusid. Originally published in Construction Marketing Today, Copyright © 1994